Taxes after subtotal

Indicate taxes to be calculated after the subtotal. That is, the tax is calculated after calculating Quantity x Price.

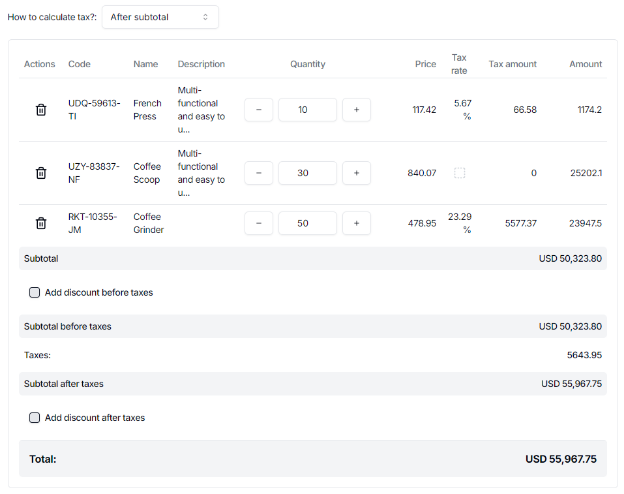

Take a look at the following list of products.

Tax on each item is calculated using the formula below.

(Quantity x Price) x (Tax rate / 100)

| Product code | Quantity | Price | Tax rate | Quantity x price | Individual tax amount |

|---|---|---|---|---|---|

| UDQ-59613-TI | 10 | $117.42 | 5.67 | $1,174.20 | $66.58 |

| UZY-83837-NF | 30 | $840.07 | 0 | $25,202.10 | $0.00 |

| RKT-10355-JM | 50 | $478.95 | 23.29 | $23,947.50 | $5,577.37 |

| Subtotal | $50,323.80 | ||||

| Taxes | $5,643.95 |